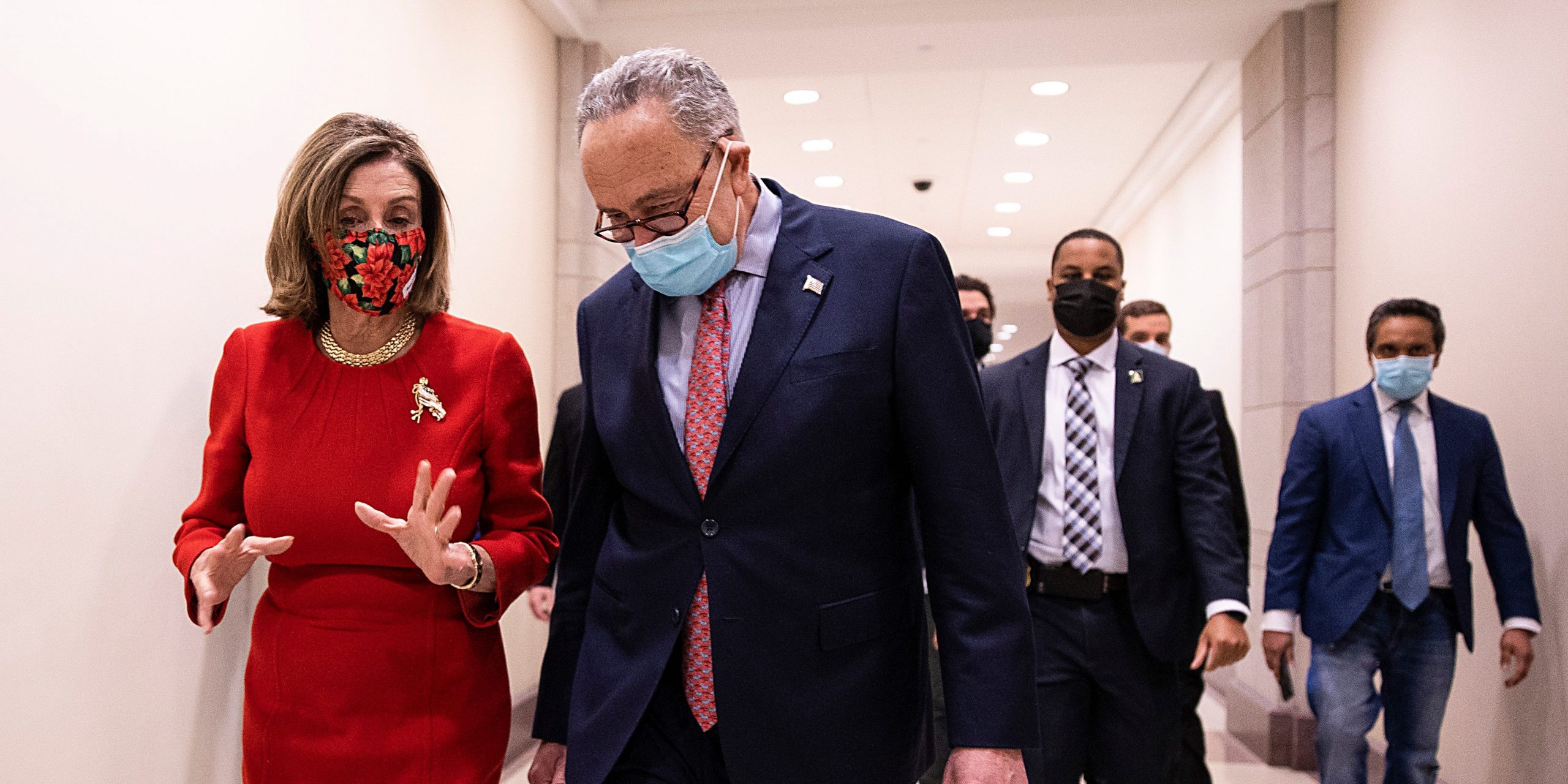

Tasos Katopodis/Getty Images

- Democrats pushing for a $15 minimum wage might need to compromise, Goldman Sachs said Monday.

- Bipartisan backing is needed for a wage hike, making an $11 minimum more feasible, the bank said.

- A $15 wage would lift many out of poverty, but studies show it also has negative effects on hiring.

- Visit the Business section of Insider for more stories.

The $15-per-hour minimum wage sought by Democrats may be too lofty a goal, economists at Goldman Sachs said Monday.

President Joe Biden and Congressional Democrats are pushing to gradually lift the federal minimum wage over the next four years. The nominal wage was last increased in 2007 to its current level of $7.25. Meanwhile, the real minimum wage – the baseline adjusted for inflation – has steadily declined over the last five decades.

The proposed increase almost certainly requires unified support from Congressional Democrats, but more moderate members of the party have hinted they aren’t yet on board with such a large hike. Some fear the higher baseline will cut into the hiring of low-wage workers. Others see the policy as too broad to fit each state well.

The chances of a $15 minimum wage passing in the near term are low, economists led by Jan Hatzius said in a note to clients. A compromise of between $10 and $11, enacted at a rate no faster than $1 each year, has a better chance of garnering adequate support, they added.

To be sure, a $15 minimum would have significant benefits for low-income Americans. Goldman estimates that 30% of workers would benefit from the direct and spillover effects of such a wage hike. More than half of that proportion would be adults with family incomes below $50,000, the bank added.

A Congressional Budget Office study published Monday echoed Goldman's findings. A $15 minimum wage by 2025 would decrease the number of Americans below the poverty line by 900,000, the agency said.

Still, the policy would cut employment by 1.4 million and slightly lower economic output, the CBO added. The hit to US hiring and the hike's price tag will likely keep Republicans and moderate Democrats from backing the $15 minimum.

Democrats have three avenues for pushing a wage increase through, according to Goldman. The party could attempt to pass the law through reconciliation, but the "Byrd Rule" blocking non-fiscal legislation from the process would hinder efforts.

The party could also try to change Senate rules to abolish the filibuster, but misgivings among more moderate members make such a strategy unlikely, Goldman said.

The third and final method for a minimum wage increase hinges on bipartisan support. Democrats would likely need to bring down their proposed minimum to attract the 10 Senate Republicans needed for passage. Previous comments from moderate Democrats suggest the bank's $10 to $11 minimum could win over the necessary number of senators, the team said.

JPMorgan also sees a lower minimum standing a better chance of passage. Lifting the baseline wage to $12 by 2026 would have a smaller negative impact on hiring, inflation, and real family income, the team led by Michael Feroli said in a January 29 note.

"It's conceivable the minimum wage could be raised by a few dollars, but it is harder to see agreement on the president's $15 minimum wage proposal," they added.