Drew Angerer/Getty Images

- Passing Democrats' spending plan is the difference between a stellar and a subpar recovery, according to Oxford Economics.

- Failure to do so would slash economic growth and delay a full labor-market rebound, the firm says.

- Democrats aim to pass a measure in September, but key disagreements risk killing the plan altogether.

- See more stories on Insider's business page.

Passing Democrats' latest spending plan could mean the difference between a stellar economic rebound and a subpar recovery that lasts for years, experts at Oxford Economics said Wednesday.

Congressional Democrats are currently pushing forward with plans to pass President Joe Biden's sweeping infrastructure proposal. Details around the plan – which includes $3.5 trillion in spending – have slowly emerged as House committees finalize their portions of the bill. But as Democrats near their September deadline for passing the plan, disagreement over key elements such as the child tax credit and the price tag threaten to delay a vote.

It might be better for Democrats to move forward with a smaller package, as failing to pass new spending would seriously hamper the US recovery, economists Nancy Vanden Houten and Gregory Daco of Oxford Economics said in a note. The team expects Democrats to shrink the latest spending proposal to $2.5 trillion before passing it through budget reconciliation. If lawmakers fumble efforts to pass the smaller measure with the $550 billion bipartisan infrastructure plan, the recovery will suffer for years, the economists said.

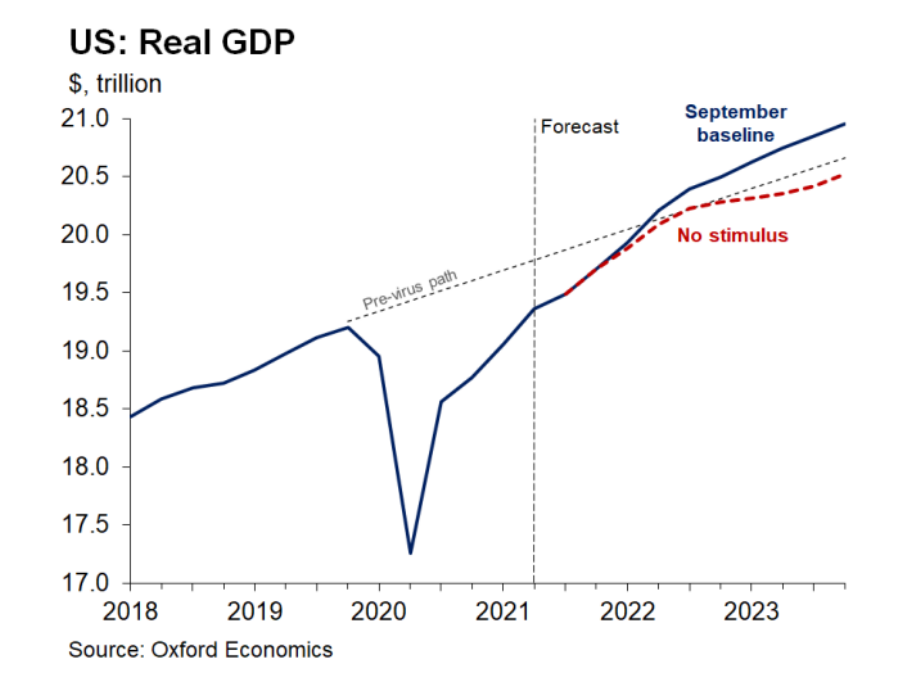

Oxford Economics

For one, the US economy won't grow nearly as fast. Failure to pass the bills would cut 2022 growth to 3.7% from 4.4%, Oxford Economics said. Growth in 2023 would slide by 1.4% from 2.6%.

It would also drag on the labor market's rebound. A lack of new spending would lead to 1.2 million fewer jobs being created, according to the team. The unemployment rate would only fall to 4.2% through 2023, instead of 3.5% in the firm's baseline scenario that sees both measures passing.

More broadly, botching both plans' passages would leave the country struggling to return to its pre-pandemic economic health. Passing both packages would help US gross domestic product outpace its pre-crisis trend early next year, according to Oxford Economics' forecasts. That would mark a substantial victory over the pandemic after nearly two years of harsh economic pain.

Conversely, a dearth of fresh stimulus dooms the country to a substandard recovery. Gross domestic product growth would retake its pre-crisis trend in 2022 but quickly slow and remain below the critical level well into 2023, the economists said.

Approving both bills, then, can determine whether the country ever returns to its pre-COVID welfare.

"September will be a pivotal month for the trajectory of US fiscal policy and President Biden's domestic policy agenda," the team said. Failure to pass the spending packages would drag on the economy just as other fiscal boosts are set to fade, they added.

Oxford Economics' latest forecast comes after several banks slashed their own outlooks for the recovery ahead. Bank of America and Goldman Sachs nearly halved their GDP estimates in August, blaming the Delta wave and weaker spending for the gloomier projections.

JPMorgan followed on Wednesday, cutting its third-quarter growth forecast to 5% from 7%. While some of the lost growth will show up in the fourth quarter, much is permanently lost to supply-chain issues and weak demand, Michael Feroli, chief US economist at JPMorgan, said in a note.

With Delta case counts climbing higher through September, the US recovery is on the ropes. Democrats' efforts to pass trillions of dollars in new spending could decide whether the rebound accelerates or runs out of steam.