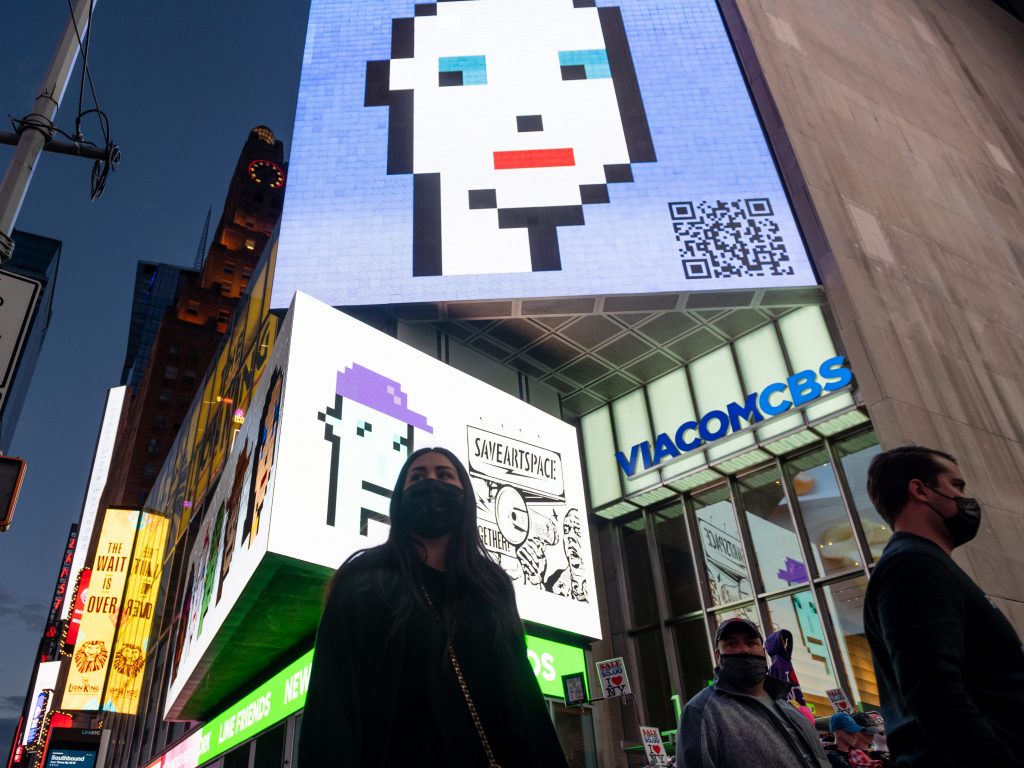

- Blockchain enthusiasts have been finding clever ways to allow NFT enthusiasts to take advantage of the mania surrounding digital art.

- NFT indices have been gaining prominence on several exchanges in Canada and the UK.

- Crypto businesses underpinning the NFT craze are receiving sky high valuations, some well into the billions.

The celebrity stardust sprinkled over the non-fungible token [NFT] world has certainly added to its appeal, but if you’ve only got a few hundred dollars to spare, a direct purchase of digital art may not be the best way into this booming market.

Like other nascent technology trends, serial investor Jonathan Bixby learned early there is more money to be made in investing in digital infrastructure. He already achieved success with his previous business Argo Blockchain, which took off when crypto mining — underpinned by blockchain technology — saw a revival a few years ago.

“Now I’m [considered] a smart guy, even though I was [considered] a dumb guy back in the day,” he told Insider.

He applied the same thinking in his latest venture, NFT Investments, which is also listed in London on the AQSE Stock Exchange Growth Market. It’s regulated by the Financial Conduct Authority, the UK securities watchdog.

“I am going to be super transparent. I was super skeptical, like $100,000 for digital cats seemed really dumb to me,” he said. “And then I sort of dove into it and realized that outside of mining, NFTs are the first example of blockchain monetizing at scale. That’s a huge deal,” he told Insider in a recent interview.

"You don't have to own NFTs. We own NFTs infrastructure for you. That's essentially the thesis," Bixby said.

Non-fungible tokens (NFTs) are cryptographic tokens that live on the blockchain and can represent items, such as art, music and real estate. Each token is effectively a digital collectible item and cannot be exchanged for another, the way a cryptocurrency can be. Digital cats, virtual land, digital art - anything and everything can be tokenised and sold on.

Celebrities from rappers Snoop Dogg and Eminem, to rock star Mick Jagger, Tesla CEO Elon Musk, skateboarder Tony Hawk and model Kate Moss have all launched their own tokens, and investors big and small flocked to this market in droves, particularly in the early part of this year.

A third of Bixby's fund is focused on NFT infrastructure, another third on owning tokens, and the final category is fashion NFTs. He's invested in Ethereum, but also in lesser known crypto reserves, such as Wax Tokens and Dapper Labs' Flow blockchain, which commonly underlies sports NFTs. He's also investing in early stage NFT companies, such as AEON International, which focuses on digital works in the high fashion realm that he will eventually help co-create and monetise with the support of fashion houses and celebrities.

He wouldn't disclose how much he has made his clients since launching in April 2021, but the stock has hovered within the range of $4.00-7.00 a share during that time.

Early investors in Bixby's business largely hailed from institutional ranks, followed by high net worth individuals. The initial initial public offering was oversubscribed, securing roughly $50 million after the team sought out to raise around $14 million.

"So we have crazy billionaires in our deal, huge art collectors, sports franchise owners, people that saw how impactful this could be for their businesses and their hobbies, like art collecting," he said. "And then the third one is general investors [or] retail investors."

The market capitalization of the NFT industry is around $15.6 billion, with a trading volume of $2.3 billion worldwide, according to CoinMarketCap. NFT token sales have also reached the $100 million mark, spanning from art, to video games and even digital plots of land being tokenized.

Experts say the rapidly growing virtual economy is valued at $100 billion, with some projecting it could grow into a trillion-dollar industry in the years to come.

But it's volatile. According to Nonfungible.com, weekly sales of NFTs hit a peak of over $176 million in the week to May 9. That's now fallen to just $13 million as a lot of the heat has come out of that market.

Direct investing

While indices are just one option when trying to ride the NFT wave, another is directly investing in tokens yourself, according to Scott Morgan, an expert who said he predicted the crypto and bitcoin price crash of mid-April.

"Eventually, more money will be made by centralized action on exchanges to offer and sell/transfer NFT's than on NFT re-sale profits" he said.

As a result, he advises novice traders to "save some of your money to buy into the system. This is where, he adds, the "big rush" of industry enthusiasm will allow you to "be making actually most of your profits on the trading [platforms] than the other things."

Ethereum is one of the most popular networks that supports NFTs and other digital collectibles, and investing in its ether token could be a savvy move, according to Morgan. The digital platform has a market cap of $286.2 billion, according to CoinMarketCap.

You cannot buy direct shares of Ethereum in traditional capital markets, but you can have exposure by investing in ether, with the expectation that it will increase in value over time.

In a major step forward for the digital coin industry, the Toronto Stock Exchange also approved three ethereum ETFs with direct exposure to ether in April.

"For investing in a leader in this field, the majority of the protections are built on Ethereum software, or basic 'smart contracts', which is why ether will live on, even if bitcoin fails," Morgan said.

It's all in the fine print

Companies that support loyalty and patent protection are also worth looking into, Morgan said.

"Arguably, the two best are Bitfury and TRON services for patent and royalty protection," added Morgan. "Celsius Network pays a sort of 'interest' to people holding TRX on their platform. And the next era of games will have what they call "interoperable tokens", which will be redeemable in the real world for money or products."

Several of these companies are opening themselves up to investors.

Last year, Bitfury announced the launch of its institutional investor program, which gives high-net-worth individuals and firms an alternative investment vehicle to gain exposure to bitcoin and digital currencies market. Celsius Network is also now featured on the Bnk to the Future a global, online investment platform. It enables individuals to become early stage investors in the technology company, among others in the financial technology space.

Celsius, a leading crypto rewards-earning platform, has grown its customer base by 300% to almost 500,000 users in the last year alone, according to Coin Journal. The digital asset investment firm Alpha Sigma Capital estimates Celsius is worth $3.13 billion, and is expected to experience a 25% yearly surge in assets under management over the next four years.

With the opening of Chinese courts to deal solely with the protection of intellectual property, copyright, patent and other related trademark issues in the digital space, the industry is becoming increasingly standardized, moving away from its wild-west reputation.

"NFTs will not only be protecting the companies issuing them, almost all companies [will] want brand protection, [and] "smart contracts" enable this," he said.