Stocks across the world are charging on Monday after the announcement that the latest investigation into US presidential nominee Hillary Clinton’s private email server found nothing new.

The FBI director, James Comey, told Congress on Sunday that a review of newly discovered emails in relation to the bureau’s investigation into Clinton’s use of a private email server while serving as secretary of state had not yielded any reason for charges against the Democratic presidential nominee.

The announcement most likely increases Clinton’s chances of winning Tuesday’s election and becoming president.

Clinton is favoured over her Republican counterpart, Donald Trump, in the markets. She is seen as a steady pair of hands while Trump is thought to be something of an unknown – and as we know, markets hate uncertainty.

All of Europe’s major stock indexes were rocketing in trade on Monday, climbing by more than 1% in their first session after the weekend.

In Britain, the FTSE 100 has climbed by more than 1.3%, bouncing back from a bad few days last week. Here is the chart as of about 2:10 a.m. GMT (9:10 a.m. ET):

Britain's benchmark index tumbled in trade last week after the pound rallied on the High Court's ruling that Parliament must be allowed to vote on the triggering of Article 50.

About 70% of the revenue of the companies that make up the FTSE 100 is derived from abroad, meaning they make more money when sterling is weak. That is because the index is full of mining companies, oil firms, and pharmaceutical giants that use the UK as a base but tend to denominate their assets in dollars. That goes in reverse, so when sterling is strong, stocks in the UK tend to fall.

Elsewhere in Europe, moves are broadly similar, with Germany's DAX higher by just over 1.5%. Here's the chart:

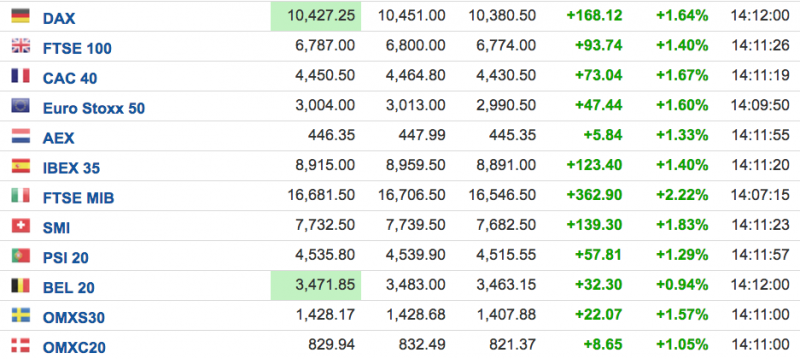

And here is the broader scoreboard - a sea of green:

Reaction to the news of Clinton's clearing was also strongly positive in the US futures markets, with all three major US bourses higher by more than 1%. The Dow Jones 30 is up 255 points, or 1.43%, the Nasdaq is up 1.58%, or 73 points higher, and the S&P 500 has gained 1.44%, just shy of 30 points.

Markets in Asia set the tone for Monday's rally, posting substantial gains during trade. Before European markets opened, Japan's Nikkei 225 closed 1.6% higher, while Hong Kong's Hang Seng picked up 0.7% and Australia's ASX rallied 1.35%.

In European currencies, the rally in the pound - which enjoyed its best week against the dollar since the financial crisis in percentage terms last week - seems to have run out of steam, with traders reluctant to push sterling much higher after last week's late rally.