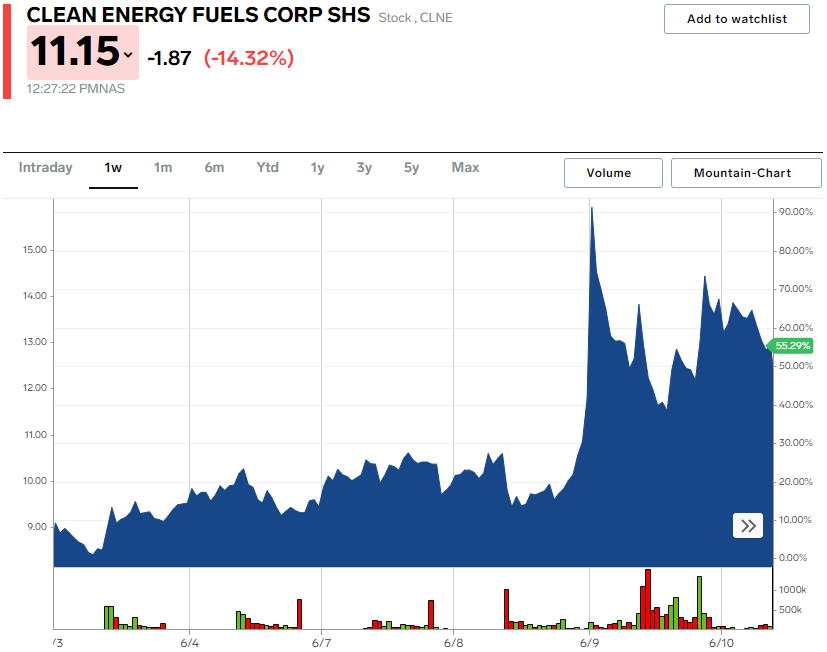

- Clean Energy Fuels stock sank as much as 17% on Thursday.

- The fall came after the company's largest shareholder, TotalEnergies, sold more than 10 million shares.

- TotalEnergies still holds 53.4 million shares of Clean Energy Fuels.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Clean Energy Fuels stock sank as much as 17% on Thursday after regulatory filings revealed the company's largest shareholder, TotalEnergies SE, cut its stake by more than 10 million shares.

TotalEnergies owned 53.44 million shares, 26.7% of shares outstanding, according to an SEC 13D filing released on Wednesday.

That's compared to the 64.04 million shares, 32% of shares outstanding, the company owned as of Monday, according to a separate filing.

Clean Energy Fuels investors might also be concerned about disappointing quarterly results from the company's clean energy peer, FuelCell Energy, which posted a larger than expected loss and saw revenues sink 26% year-over-year in its fiscal second-quarter report Thursday morning.

Clean Energy Fuels stock has been on quite the run of late. The price jump began last Thursday when social media chatter about the firm spiked 445%, causing shares to surge as much as 36% on the day.

This week, Clean Energy Fuels was swept up in the meme stock fervor, with shares rising as much as 50% on Wednesday as the Reddit crowd piled in.

The stock was among the top-trending companies on Reddit investing threads like r/wallstreetbets this week, according to HypeEquity data, with the phrase "short squeeze" being a common theme.

Reddit traders have been targeting companies with high short interest rates hoping to force a short squeeze, which can rapidly drive up stock prices resulting in quick gains for shareholders.

According to data from ShortSqueeze.com, Clean Energy Fuels currently has a short interest rate of 6.59%. However, the percentage of shares sold short has dropped dramatically since the Reddit crowd targeted the company.

Wall Street analysts were mostly bullish about Clean Energy Fuels before it gained Reddit darling status. Most recently, on May 11, Needham & Company maintained its "buy" rating and $12 price target for the Newport Beach-based firm.

Shares of Clean Energy Fuels traded down 14.32% as of 12:27 p.m. ET on Thursday.