The competition over a new class of cancer drugs is heating up.

On Thursday, drugmaker Bristol-Myers Squibb said that it wouldn’t go for an accelerated US approval for a combination of its two immunotherapy drugs as an initial treatment for lung cancer – helping its rival, Merck pull ahead.

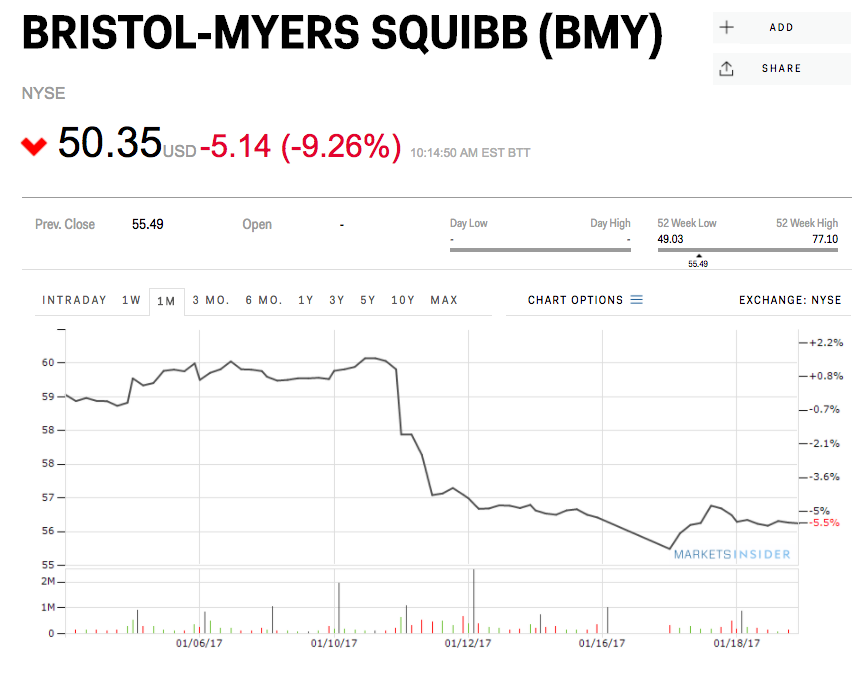

Shares of BMS were down 9% Friday morning on the news, while Merck was up 3.6%.

BMS cited “a review of data available at this time” for the decision to hold off on filing for Food and Drug Administration approval of the combination of its cancer drugs Opdivo and Yervoy.

Jefferies analyst Jeffrey Holford said in a research note that he still expects the BMS immunotherapy combination to be approved in the second half of 2018 and sees "no real change to valuation or estimates as a result of this update."

But the move helps secure Merck's current lead in the development of combination lung cancer treatments.

Merck last week said U.S. regulators had agreed to an accelerated review of its application to combine immune system-boosting drug Keytruda with chemotherapy as an initial therapy for advanced lung cancer.

Merck said the FDA would decide by May 10 whether to approve its combination treatment.

Why the combination cancer treatment is key

Lung cancer is the second most common type of cancer, after breast cancer, and it's one of the deadliest.

Keytruda and Opdivo, which both block a protein called PD-1 to boost the ability of the body's own immune system to kill cancer cells, are already approved to treat a range of cancers, but their biggest market would be first-line lung cancer. Yervoy targets a different protein called CTLA-4.

Immunotherapy is revolutionizing some areas of cancer care but giving it on its own only seems to work better than chemotherapy in previously untreated lung cancer patients who have high levels of a protein called PD-L1. Merck's Keytruda is already approved for such patients.

But not everybody responds to the PD-1 drugs. Just a quarter to a third of non-small cell lung cancer (NSCLC) patients have tumors with at least 50 percent of cells producing PD-L1. That leaves about 70% of the market still up for grabs for combinations that could include chemotherapy or other forms of immunotherapy.

Jefferies' Holford said he still expects the front line, or initial, treatment of NSCLC patients to evolve toward combinations of immunotherapy drugs without chemotherapy, where BMS and AstraZeneca have super positions.

Reuters reporting by Deena Beasley.