LONDON – The number of full-time staff working in shops is collapsing, new figures show.

The number of people working in retail shop floors across Britain fell by 2.4% in the first quarter of 2017 compared to the same quarter a year ago, according to the British Retail Consortium (BRC), while the total number of hours worked fell by 3.9%.

Full-time employees saw the biggest fall in number of hours worked, down 6%, while part-time staff saw a 2.1% decline in hours.

The figures cover everything from supermarkets to clothes shops, DIY warehouses to electronics outlets.

They show retail is going through seismic changes, beset by online competition, rising costs, and cash-conscious consumers.

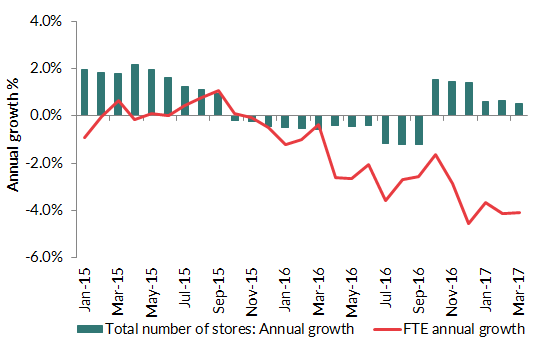

Retail employment declined in all three months of the first quarter, BRC says, and full-time employment has now been declining since October 2015.

BRC CEO Helen Dickerson says in a statement: "Today's fall in full-time equivalent employment from our sample of retailers shows a continuation of a year-long downward trend of retailers reducing the number of hours being worked."

Traditional retailers are facing increasing competition from online rivals who can undercut them on price as they do not have to pay rents or business rates and have lower staffing costs. As a result, many are looking to slash costs in a bid to remain competitive. John Lewis announced in February that it is planning to cut 800 jobs, the department store's largest ever redundancy round.

However, demand is also suffering. Retail sales collapsed by 1.8% in March, compared to a forecast of just a 0.2% fall.

Competition, rising costs, and waning consumer demand have pushed several retailers to the wall. Jones Bootmaker and Agent Provocateur both went into administration in the first quarter, with Jaeger following recently. In Jaeger's case, this has led to over 200 jobs being cut.

However, it is not just clothing and apparel retailers feeling the squeeze. The BRC said that it was, in fact, food retailers that saw the biggest fall in staffing numbers in the first quarter of the year. Sainsbury's announced last month that it is cutting 400 jobs. Waitrose, part of the John Lewis Group, is putting up to 700 jobs at risk with the closure of 6 of its supermarkets.

The BRC expects problems to continue for retailers. Dickerson said: "We expect retailers to continue reviewing how they work with their people as they look to address the changing face of retail and keep prices low for consumers."

14% of retailers surveyed by the BRC expect to cut staffing numbers in the next quarter, compared to 0% this time last year.

Dickerson said: "Building inflationary pressures and public policy costs, alongside intense competition, are taking their toll and retail, as a people intensive industry, is being hit hard."

Inflation hit 2.3% in March and is forecast to top 3% later this year, meaning prices are rising faster than wages and putting a squeeze on consumers. New business rates - a tax based on shop space - also came into effect at the start of this month, adding to costs for many retailers. The Centre for Retail Research forecast in December that 2017 could see as many as 30,000 retail jobs disappear.

Despite the fall in full-time retail employees in the first quarter, the BRC found the number of shops in the UK actually rose 0.6% compared to a year ago.