Dan Kitwood/ Getty Images

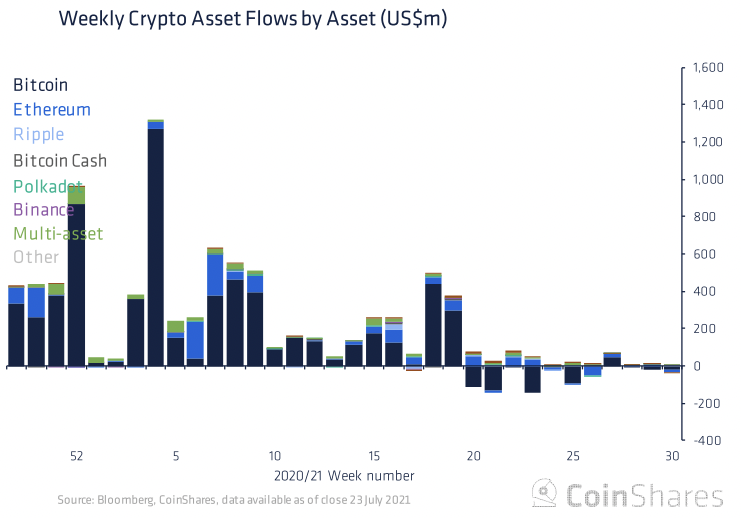

- Bitcoin experienced $24 million in outflows over the week ending on the July 23, the largest since mid-June according to CoinShares.

- Ether experienced outflows of $7.3 million, the first in 4 weeks.

- Data suggests "negative sentiment" towards crypto in that week but prices have since recovered.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Bitcoin saw a third consecutive week of outflows last week, while ether saw investors pull money for the first time in four weeks, as the cryptocurrency market came under intense pressure, turning sentiment negative, according to a weekly report from Coinshares on Monday.

Bitcoin, the largest crypto coin by market capitalization, saw outflows reach $24 million – the most since mid June – while ether, the second largest by market cap, saw $7.3 million in outflows, following three straight weeks of inflows.

"Last week's outflows still suggests negative sentiment pervades the asset class despite more recent constructive comments from key industry players," CoinShares said in a weekly report.

Coinshares

CoinShares is Europe's biggest crypto asset manager, with around $3.35 billion under management by the end of the first quarter, according to its most recent earnings report. The data tracks investment capital flows around the world.

China's crackdown in June that severely restricted crypto trading and mining, has been one of the most impactful developments in the digital assets market, industry experts told Insider.

However, a series of bullish comments from key crypto influencers such as Ark Invest's Cathie Woods and Tesla CEO Elon Musk in the past few days unleashed a wave of buying over the weekend and into Monday that pushed bitcoin and ether to their highest in over a month.

On Monday, bitcoin rose by around 15% to above $39,000, while ether rose around 10% to almost $2,400, lifted to their highest since mid June by reports that Amazon might introduce crypto payment later in the year. Amazon on Tuesday said it had no concrete plans to look into crypto payments but said it had interest in the space.

Over the week ending on July 23, CoinShares data showed net flows for bitcoin in the year to date are still positive at $4.1 billion.

Multi-asset products, such as the Bitwise 10 crypto index fund, were the most popular among investors in the latest week, with the strongest inflows, according to the report. Inflows reached $3.1 million in the latest week.

XRP saw $700,000 worth of inflows over the week to July 23, while the cardano network's ada token registered outflows of $1 million in that time, the report showed.