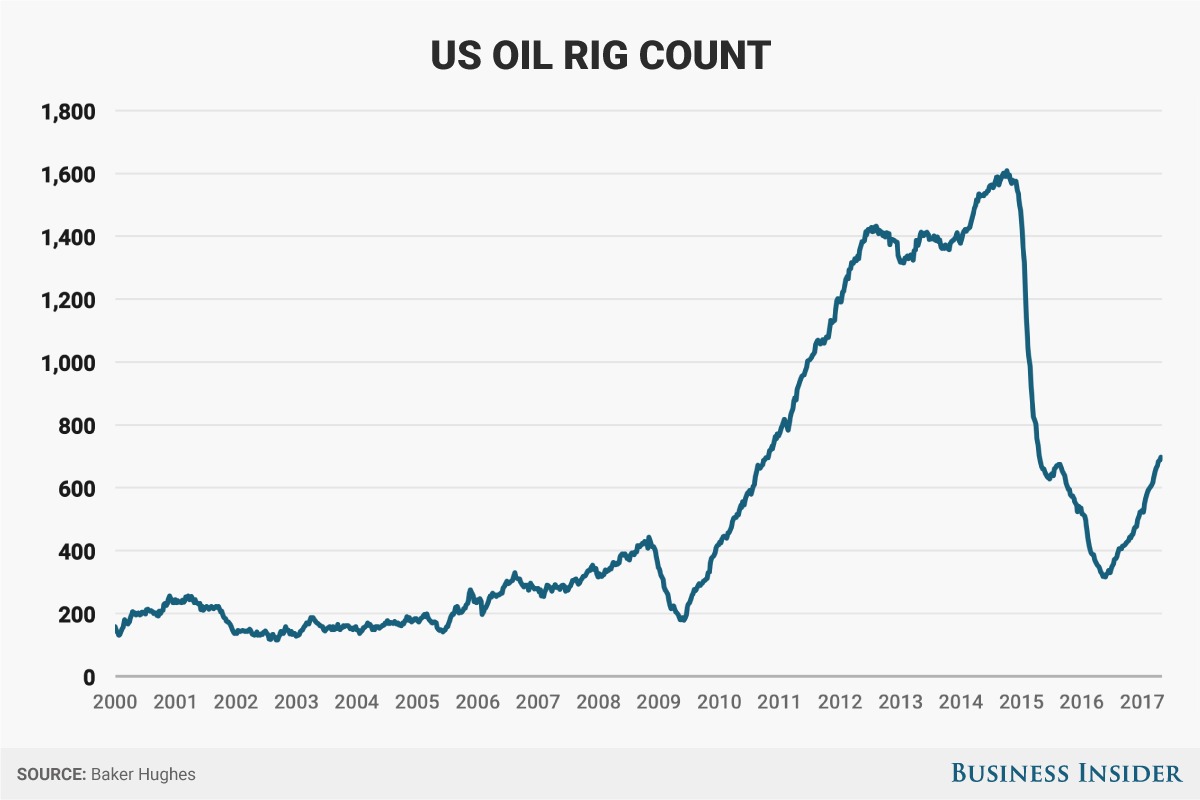

The US oil-rig count increased by nine to 697 this week, according to Baker Hughes.

The rise demonstrated again that explorers continue to take advantage of higher oil prices. Schlumberger and Halliburton – the two largest oilfield-services companies – this week reported first-quarter earnings that showed stronger demand. As a whole, the energy sector is expected to be the biggest contributor to year-over-year S&P 500 earnings growth.

Gas rigs increased by four to 171. With miscellaneous rigs unchanged at two, the total rig count rose by 13 to 870.

Shortly after the rig-count release, West Texas Intermediate crude oil futures were little changed, up by 0.4% at $49.19 per barrel. WTI was headed for a 0.8% weekly drop and a second-straight monthly decline as concerns persisted over the level of global inventories. Data released on Wednesday from the Energy Information Administration showed that gasoline stockpiles jumped last week even as crude inventories fell more than expected.