Pear Therapeutics

- Apps and video games that can treat health conditions nabbed $1.2 billion in VC dollars in 2019.

- Only a few commercial products have been launched so far, and they're struggling to penetrate the healthcare system.

- Experts say this field is primed for consolidation and could be a great target for telehealth firms.

- This article is part of a series called "Future of Healthcare," which explores how technology is driving innovation in the development of healthcare.

Pear Therapeutics is a leader in its field. But the announcement last month that it would go public in a $1.6 billion deal with a special purpose acquisition company, or SPAC, raised eyebrows.

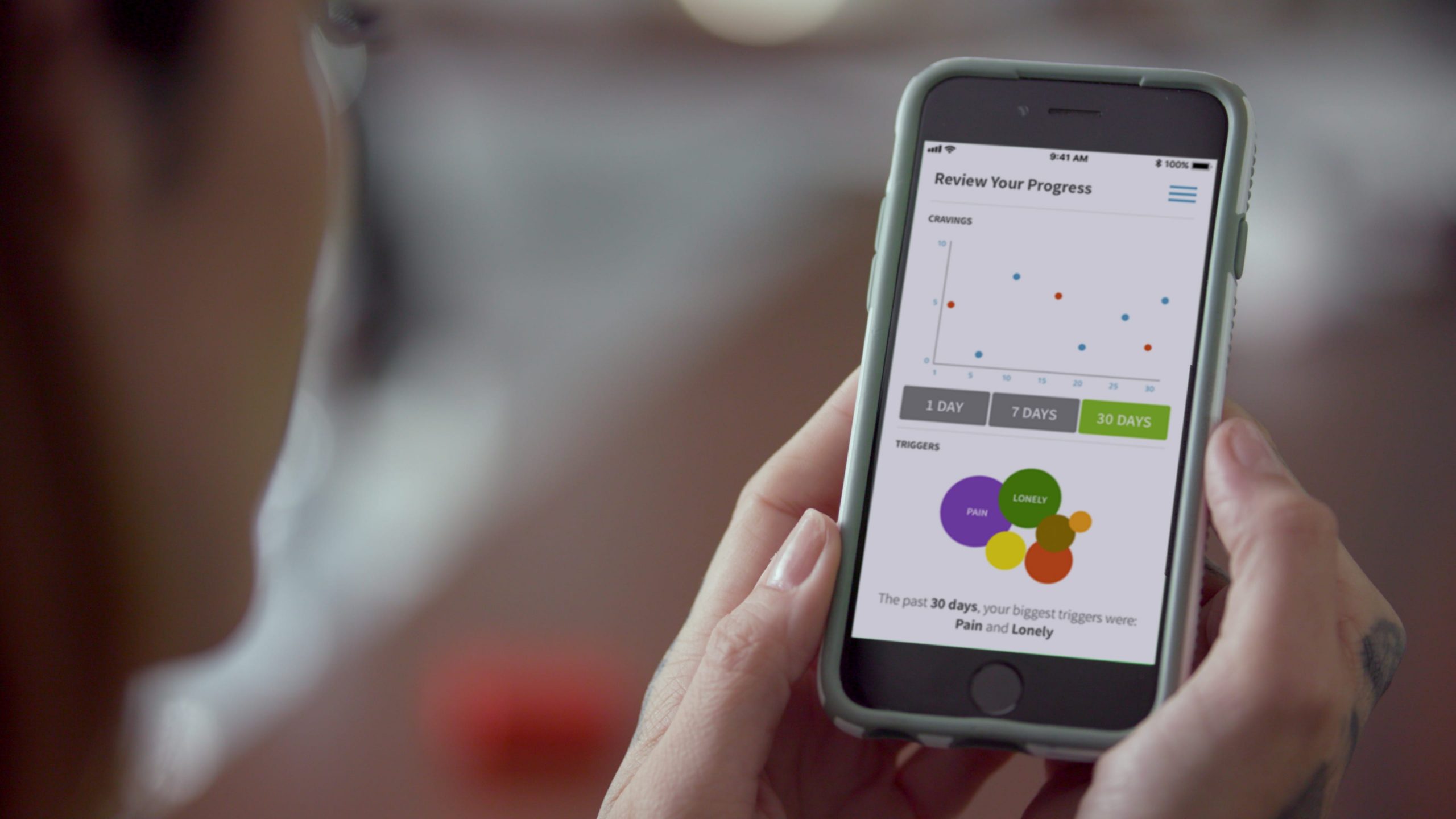

Pear sells three apps designed to treat opioid abuse, substance abuse, and chronic insomnia. But it's only expecting to make $4 million in revenue this year.

It's emblematic of where the young field of digital therapeutics stands today. The technology is theoretically promising, but the business model is completely up in the air. Most health insurers don't cover these products, nor are many physicians prescribing them.

Digital therapeutics are technologies like cell phone apps or virtual reality games that are designed to treat different diseases. In many cases, they target underserved mental health or neurological conditions like post-traumatic stress disorder and schizophrenia.

The plethora of small, young digital therapeutics companies needs a savvy business partner. Pharmaceutical and telehealth companies each stand out as prime options. But, it's not clear which will truly engage with this new healthcare technology.

"Digital therapeutics, despite being around for a number of years now, it's still in an early stage of market development. I think the next few years are going to be about what kinds of businesses are best to shepherd through any special clinical benefits," Jeff Liesch, a consultant at Blue Matter Consulting, told Insider.

As this gets worked out, the digital therapeutics field is likely to see a wave of M&A.

"Consolidation will come, and we're seeing it coming," Liesch said.

Pharma giants like Novartis, Roche, and Sanofi have been exploring prescription apps

Digital therapeutics startups are getting their fair share of the investment dollars flowing into the healthcare industry. The amount of venture capital investment in digital therapeutics grew from $134.3 million in 2015 to $1.2 billion in 2019, according to Pitchbook. Another $709 million was invested in the first nine months of 2020, the most recent data available.

Pharma giants like Novartis, Roche, and Sanofi have expressed an interest in the field. Novartis partnered with Pear to launch a schizophrenia therapy, but dropped that project in 2019. It later acquired a digital therapeutics startup developing a 3-D video game to address lazy eye.

Reuters

Digital therapeutics, particularly those that are prescribed by a physician instead of released directly to consumers, play to pharma's regulatory strengths while cutting down on the 10-plus years it can take to develop a chemical drug.

The prescription route is where the money is: the annual US revenue expectations for digital therapeutics range between $100 million and $300 million, according to a Blue Matter report.

Before agreeing to pay for them, insurers want to see long-term data showing how the benefits of these prescription apps or video games last. But, multi-year clinical trials are expensive and there's a chance that at the end of it all, the technology will be outdated, ZS Associates Principal Pete Masloski said.

Even if the companies can get insurers to pay for their products, there's still the barrier of getting physicians to prescribe them.

Eddie Martucci, the chief executive of digital therapeutics company Akili Interactive, said that thousands of doctors have reached out since the company got Food and Drug Administration clearance last year for an app to treat attention deficit and hyperactivity disorder. But its commercial sales to date are small.

Dina Rudick/The Boston Globe via Getty Images

At this point, less than 5% of physicians in the US are exploring and prescribing digital therapeutics, according to Masloski.

The next generation of digital therapeutics startups are building in telehealth options

As a young digital health company, is it even worthwhile to try to educate and convince thousands of physicians to prescribe your app? Masloski estimates that time may be better spent by teaming up with a telehealth company with a specialized focus - be it mental health, chronic diseases, or something else - and a pool of medical specialists at hand.

One telehealth firm, UpScript, has already begun offering consultations for Pear's prescription digital therapeutic. Meanwhile, the next generation of digital therapeutics companies like Happify Health and Kaia Health are building healthcare support staffs around their products.

Kaia Health

A wave of M&A is just now hitting the telehealth and digital health space, with big names like Teladoc, Ro, and others acquiring smaller players. The digital therapeutics field may also get swept up in that, Masloski said.

"Digital health companies are looking more broadly at ways to expand their impact across different parts of the patient journey. They're thinking in a platform way, how can I offer employers, for example, diabetes management, mental health services, all of these things?" he said. "They don't want to work with 1,000 individual different providers. They want to work with platform companies, simplifying their world."