- Daniel Ives of Wedbush said in a Monday note that investors should “take a deep breath and focus on the tech winners for the next 5-10 years, including Apple front and center,” amid the market rout.

- While the coronavirus outbreak has disrupted Apple’s supply chain and hit demand, Ives believes it will be a short-lived “shock event” that the company will recover from in the second half of the year.

- Ives also thinks Apple could ship more than 231 million iPhones in 2021, which would be a new record, he said.

- Watch Apple trade live on Markets Insider.

- Read more on Business Insider.

Worried about the current market rout? One Wall Street firm says to keep calm and focus on tech.

“We encourage investors to take a deep breath and focus on the tech winners for the next 5-10 years, including Apple front and center,” Daniel Ives of Wedbush wrote in a Monday note. He maintained his “buy” rating on the stock, and his $400 price target.

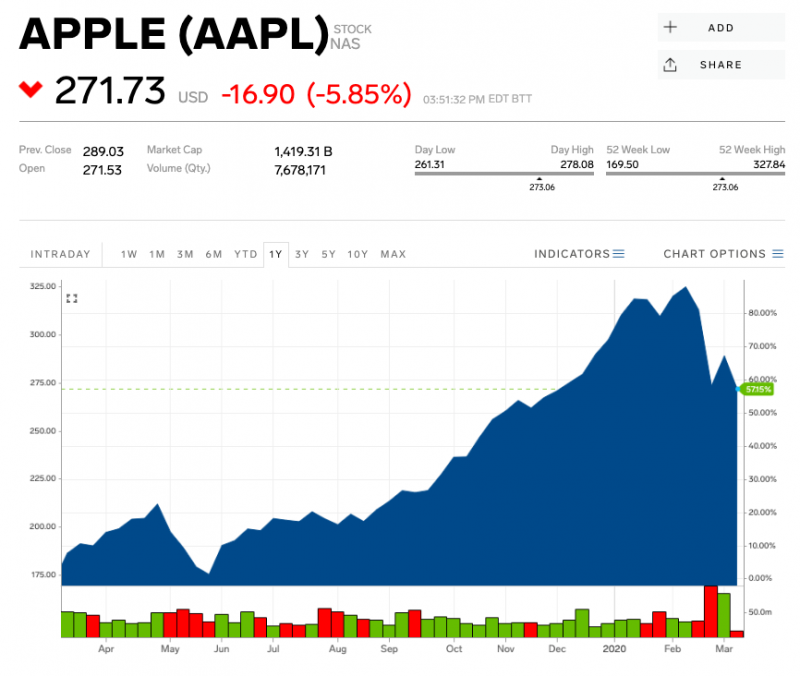

Shares of Apple were down as much as 8% Monday amid a broader market sell-off. Apple has shed 12% from its 52-week high of $327.25 hit on February 12 through Friday’s close, as the coronavirus outbreak has disrupted its China supply chains and weakened demand, forcing the company to lower its quarterly revenue guidance.

Still, the supply chain issues that Apple is facing due to the coronavirus outbreak are a “shock event” that will be short lived, Ives wrote in the Monday note. He believes that normalized iPhone demand trends will start to take hold in the second half of 2020 in China and across the globe.

Ives thinks that the company could "potentially ship north of 231 million iPhones" in the full year 2021, in an upside scenario, he said. In addition, Ives estimates that there are roughly 60 million to 70 million iPhones in China that are in the "window of an upgrade opportunity," meaning that Apple should get back on pace to convert at least half of the customers starting in June, depending on how coronavirus plays out.

"Our primary focus is that the first part of this massive upgrade opportunity on the horizon with 5G leading the way should still be in the 215 million to 220 million unit range" looking out to the end of the full year 2021, according to Ives.

"In a nutshell, this remains a major hand holding time for investors in Apple and clearly there will be some speed bumps along the way as Cupertino navigates the coronavirus outbreak," Ives said.

Apple has lost roughly 2% year-to-date through Friday's close.