- The American Express® Gold Card, which was reintroduced in fall 2018, offers some of the best credit card rewards on dining at restaurant, and spending at US supermarkets.

- When you combine the credit card’s welcome bonus, rewards program, statement credits, and other benefits, it can offer a lot of value.

- While the Amex Gold has an annual fee of $250, the rewards and benefits may be worth much more than that – depending on your shopping and spending habits.

- Here’s what you need to know to decide if the Amex Gold should be your next rewards credit card you open in 2019.

While its big brother, the Platinum Card® from American Express, often gets all the hype for premium travel rewards, Amex recently released the refreshed American Express Gold Card, and it comes with some great new rewards that make this one worth considering.

The brand-new American Express Gold comes in a sleek metallic finish. It offers up to 4 points per dollar on popular categories, a 35,000-point welcome bonus, and an annual $100 airline fee credit. The card does charge a $250 annual fee, but depending on your spending and shopping habits, this card may be well worth the cost.

American Express Gold Card details

Annual fee: $250

Welcome bonus: 35,000 Membership Rewards points after you spend $2,000 in the first three months

Points earning: 4x points at restaurants worldwide, 4x points on the first $25,000 spent each year at US supermarkets (then 1x), 3x points on flights booked directly with airlines or at amextravel.com, 1 point per dollar on everything else

Foreign transaction fee: None

American Express Gold rewards

The new American Express Gold credit card offers a great rewards program. Depending on your spending habits, it may even be more valuable to you than the ultra-premium American Express Platinum.

The card offers 4 points per dollar spent at restaurants, 4x points at US supermarkets (up to $25,000 in purchases per year; then 1x), and 3x points on flights booked directly at airlines or Amex Travel. If food and dining is a major portion of your budget, which is common because everyone has to eat, you can get massive bonus rewards for each burrito lunch, sushi dinner, or cooked at home dinner.

New cardholders also earn 35,000 bonus points after spending $2,000 on purchases in the first three months after opening a new account. That bonus alone is worth enough for a domestic round-trip flight.

Membership Rewards is one of the top two travel rewards programs for credit card holders, only competing with Chase's Ultimate Rewards for the top slot. If you want free travel but don't want to pay the big $550 annual fee for Amex Platinum, this card is an excellent alternative.

American Express Gold benefits

This card's value doesn't stop at the Membership Rewards points you earn, which are often worth around 2 cents each. The card, like other premium Amex cards, is loaded with benefits useful for travel and shopping. Some even put a few dollars back in your pocket depending on where you spend.

Amex Gold comes with two credit opportunities for dining and travel. Get up to $10 per month back in statement credits, worth $120 per year, when dining with GrubHub, Seamless, The Cheesecake Factory, Ruth's Chris Steak House, and some Shake Shack locations.

You also get $100 in statement credits for airline fees and incidentals like baggage fees and in-flight purchases. If you take full advantage of both the $10 dining fee and $100 annual travel fee credit, your annual fee goes down to an effective $50 per year. That's a bargain for what you get in return if you take full advantage.

The card also includes baggage insurance, rental car insurance, roadside assistance (like AAA), a global assistance hotline, and perks at certain hotels when booked through American Express. Surprisingly, this card does not include a full travel insurance or trip interruption benefit.

When shopping, this card offers purchase protection, return protection, and an automatic extended warranty. This is better than what the average card offers and makes big purchases a lot less stressful. You can skip the expensive added protections offered by some retailers when you make the purchase with the Gold card.

Cardholders also get a complimentary membership to ShopRunner. This service gives you free two-day shipping at a wide range of online retailers. It works like Amazon Prime in a lot of ways, but outside of Amazon.

There are some additional benefits for shopping, travel, and entertainment common to Amex cards. They are not as popular or exciting as some other benefits, but ticket presales and reserved seating for Amex cardholders at some events comes in handy to some sports fans or cardholders on the way to see a favorite band live.

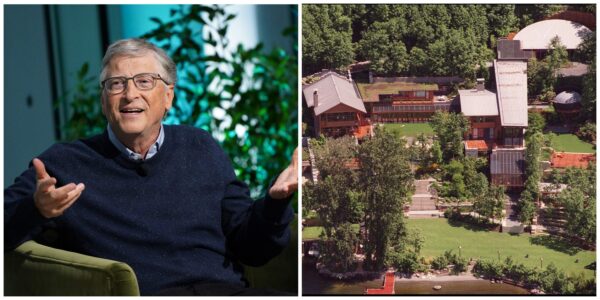

Foto: sourceAmEx

Foto: sourceAmEx

American Express Gold costs and fees

Now for the less fun part: fees. This card isn't free. It charges a $250 annual fee. But as we already established, between benefits and rewards, it is easy to earn that back and more in value if you use the card regularly.

The card charges up to $39 per occurrence for late and returned payments. Just pay on time and make sure you have enough cash in the bank when paying to avoid these costs.

There is no foreign transaction fee, so you can use the card anywhere in the world that Amex is accepted without paying the typical 3% extra most cards charge. Keep in mind that American Express is not as widely accepted outside the United States as Visa or Mastercard, so you might need an additional card as a backup when traveling.

The card charges 20.24% variable rate APR when paying over time - since this is a charge card, which you have to pay off in full each month, you'll have to opt in to the Pay Over Time program if you want to carry a balance - and 29.99% penalty APR if you miss a payment. Rates can change at any time with market interest rates. Pay in full by the due date each month to avoid interest charges.

The bottom line: Should you get the American Express Gold card?

The American Express Gold card is pretty exciting for millennials and empty nesters who enjoy dining out at restaurants or anyone who regularly dines out or spends big on groceries at US supermarkets. When you combine the welcome bonus, rewards program, statement credits, and other benefits, this card is a clear winner.

If you want even more premium travel benefits, you may prefer the American Express Platinum. If the $250 annual fee is too much for you to handle, consider the $95-a-year Chase Sapphire Preferred as a good alternative.

If you read through this card's benefits and like what it has to offer, you won't go wrong with the new and improved American Express Gold card.