- It’s been about two months since the US began sweeping lockdowns to contain the spread of the novel coronavirus.

- The economic pain of the coronavirus-induced recession swiftly overtook that of the Great Recession in that short time, with millions of Americans losing jobs, business activity freezing, and consumer spending taking a major hit.

- See below for five charts that show how the coronavirus-induced economic downturn compares with the Great Recession.

- Visit Business Insider’s homepage for more stories.

It took only a few weeks for economists to agree that sweeping shutdowns meant to limit the spread of the novel coronavirus had plunged the US economy into a recession.

Now, just two months since the first stay-at-home orders began, the ensuing downturn has surpassed the Great Recession, which spanned 18 months from 2007 to 2009.

“It just goes to show you how quickly the current crisis has evolved and how deep it is,” Daniel Zhao, an economist at Glassdoor, told Business Insider. The size and scope of the crisis are unusual for any kind of quick disruption to the economy, he added.

An overwhelming amount of data has shown the extent of the economic pain: Millions of Americans have filed unemployment-insurance claims, millions of jobs have been erased, and consumer spending, retail sales, and production have plummeted by record amounts.

The hit to the labor market has been particularly extreme. It took just four weeks for the coronavirus downturn to erase the number of jobs created since 2009 and nine weeks for unemployment-insurance claims to surpass the total filed during the Great Recession - an 18-month span.

In addition, the unemployment rate jumped in April from a 50-year low in February to its highest since the Great Depression of the 1920s and 1930s. And economists think it will be even higher in May's nonfarm payroll report.

Apples to oranges

It makes sense to compare the coronavirus-induced downturn to the Great Recession, as it's the most recent major economic event, Lindsey Piegza, the chief economist at Stifel, told Business Insider.

"No one really has the memory to think back to the '80s or the Great Depression," Piegza said. "So really the comparison that the market's going to be using is how bad is this relative to the financial crisis - that's the paradigm that we live in."

Still, there are some key differences between the coronavirus-induced downturn and the Great Recession. The US made the decision to shut off the economy to deal with a health event, unlike the Great Recession, which was caused by the financial crisis.

"This current crisis is not due to something structurally wrong with the economy," Zhao said. "It wasn't caused by a housing bubble or financial crisis."

The optimistic case is thus that activity and demand should rebound once the economy is back open, according to Zhao.

"If businesses and workers can be helped through the public-health crisis, then hopefully they would be able to resume normal economic activity quickly on the other side, and we could actually recover faster than we did after the Great Recession," he said.

Ryan Sweet, a senior economist at Moody's, said comparing the coronavirus pandemic to the Great Recession was "apples to oranges."

"I think this is more similar to a natural disaster," Sweet told Business Insider. He sees similarities in the hit to the labor force and what happened to workers following Hurricane Katrina, Hurricane Rita, and Superstorm Sandy.

To be sure, unlike with a hurricane, there hasn't been massive destruction of capital stock such as homes and businesses, and thousands of people haven't been physically displaced.

But in terms of the economy, Sweet said, "the labor force did fall sharply in New Orleans and Louisiana right after Hurricane Katrina and Rita."

The many shapes recovery might take

Even though many states have begun to reopen their economies from lockdowns, the US is still solidly in the period expected to show the depth of the impact from the pandemic. Economists forecast the sharpest drop in US gross domestic product in the second quarter, which spans April through June.

Now, economists are watching incoming data for two things - signs that indicators have reached their worst levels and are starting to rebound.

Even as states begin to reopen their economies, there's a lot of uncertainty. "I think it's still way too early to say what the shape and speed of the recovery will look like," said Zhao, adding that anyone who had assigned a letter shape to the recovery was "overly confident."

He continued: "There are all kinds of things that could happen on the healthcare side, on the public-health side, or on the policy side that could all have enormous impacts on the economic recovery."

The "letter shape" is another way of describing how quickly the economy might recover. The initial hope was for a V-shaped recovery, with a quick decline followed by an equally quick rebound. Though the rebound from the Great Recession was the longest on record, it was also very gradual.

Heidi Shierholz, a senior economist at the Economic Policy Institute, said the speed of the US recovery depended on how much stimulus was put into the economy by the government.

"That is a choice," Shierholz said. "One of the things that made the recovery from the Great Recession so bad, so weak, is that we state and local governments didn't get the aid that they needed to not have to make substantial cuts that hamstrung the economy."

Shierholz said the federal government could keep the same thing from happening this time by making sure unemployed people would have benefits and businesses would have help to stay afloat even if they aren't fully open.

If the government does those things, "when the economy does reopen, there'll be demand and confidence in the economy to get a quick bounce back," Shierholz said.

Listed below are five key measures and accompanying charts showing that the coronavirus-induced US economic downturn is worse than the one that accompanied the Great Recession.

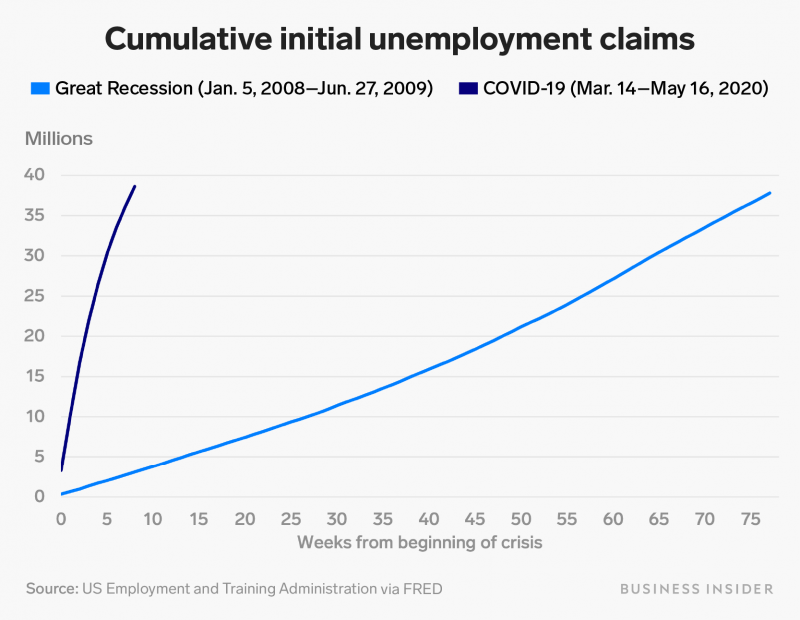

The past nine weeks have seen an unprecedented number of Americans filing for unemployment benefits.

In the week that ended March 28, nearly 6.9 million Americans filed for unemployment. This was more than 10 times the single-week peak during the Great Recession, in which 665,000 initial claims were filed in the week that ended March 28, 2009.

"Even now, nine weeks into this, we're still at the point where initial claims are more than three times the worst week of the great recession," said Shierholz, adding that the scope of losses was a "mind-boggling difference."

In addition, many states have started reporting initial claims filed through Pandemic Unemployment Assistance, a new program that gives extended benefits to people who might not have been previously eligible, such as gig workers or the self-employed.

The program is modeled after disaster unemployment insurance that goes out to specific areas hit by hurricanes or other natural disasters. In the week that ended May 16, 2.2 million Americans filed initial claims under the program, which now includes data from 35 states.

Over 38 million initial claims have been filed over the past nine weeks. That's higher than the total number of cumulative initial claims over the entire Great Recession, which lasted 18 months.

The labor-market situation is "dramatically worse" than at any time during the Great Recession, according to Shierholz.

Claims will most likely remain high, further raising the record total number.

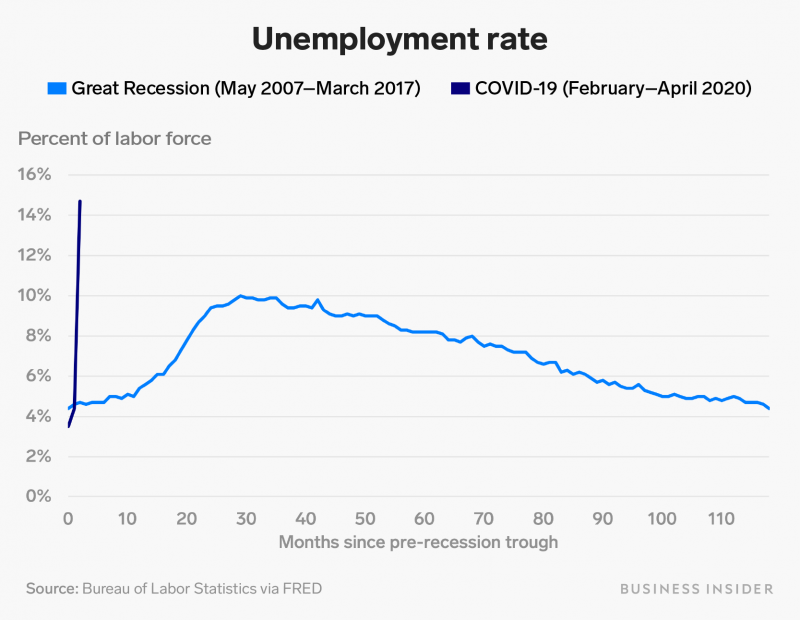

The unemployment rate in April spiked to a post-World War II high of 14.7%, well above the Great Recession-era peak of 10.0% in October 2009.

The dramatic surge in the unemployment rate in such a short period went beyond beating the Great Recession - in two months, the crisis has dwarfed every recession going back to 1948.

It could threaten the all-time-high estimate of roughly 25% unemployment during the Great Depression, as the April jobs report was most likely an undercount of economic pain.

First, there appeared to be a quirk in the data: If people who marked themselves employed but absent from work for other reasons were marked as unemployed on temporary layoff, the rate would've been roughly 5 percentage points higher, according to the Bureau of Labor Statistics.

Many workers also dropped out of the labor force during the month, most likely because of the coronavirus pandemic. A broader measure of unemployment that includes discouraged workers surged to 22.8% in April.

The unemployment rate in May could go even higher, as Americans continue to lose millions of jobs each week. Zhao of Glassdoor said unemployment would most likely rise to the high teens in May and could even break 20%.

An estimate by the Federal Reserve Bank of St. Louis thinks it could spike to 32%, higher than during the Great Depression.

Retail and food-service sales have been hit especially hard, falling nearly 25% from their peak in January.

As the labor market has deteriorated, many economic indicators have posted record drops or spikes, showing just how widely spread lockdowns' impact has been on the US economy.

Retail sales and consumer spending have tanked compared with other economic downturns because of the nature of intentionally shutting down so many businesses.

But going forward, many areas of the economy will be influenced by the way the labor market recovers.

"It is important to focus on labor-market indicators because they are tied to every other part of the economy," Zhao said. "Consumer spending is deeply tied to whether people have jobs and are making an income."

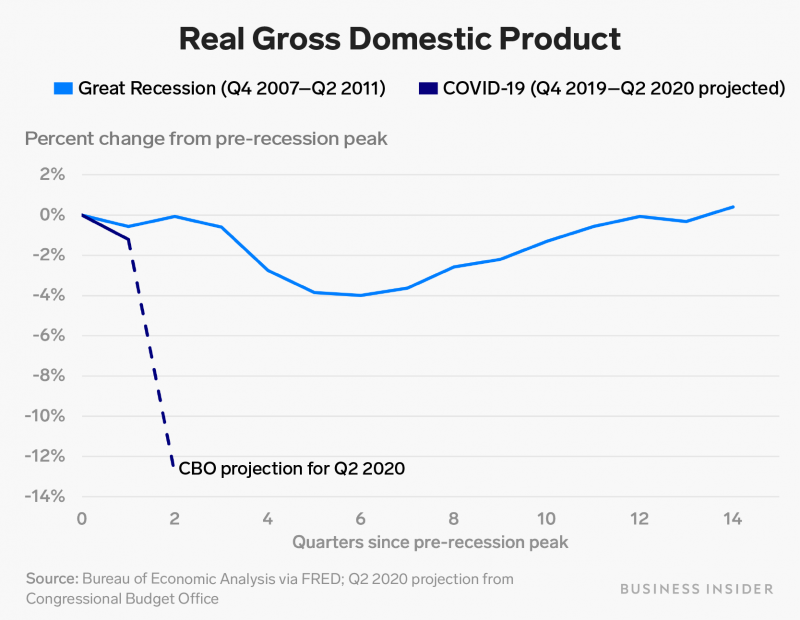

US gross domestic product is expected to post a staggering 40% drop in the second quarter, nearly five times the 8.4% slump in the worst quarter of the Great Recession.

US gross domestic product slumped 4.8% in the first quarter, its biggest drop since the Great Recession. Still, the first-quarter figure included only the first two weeks of US coronavirus-induced lockdowns, so the worst is yet to come.

Economists are forecasting that US GDP will post a sharp drop in the second quarter, reflecting the impact of coronavirus lockdowns. Major banks including JPMorgan, Bank of America, and Goldman Sachs expect GDP to contract about 40% in the second quarter - roughly in line with the government's expectations.

If GDP does fall that much in the second quarter, it will dwarf the 8.4% slump in the fourth quarter of 2008, the worst during the Great Recession.